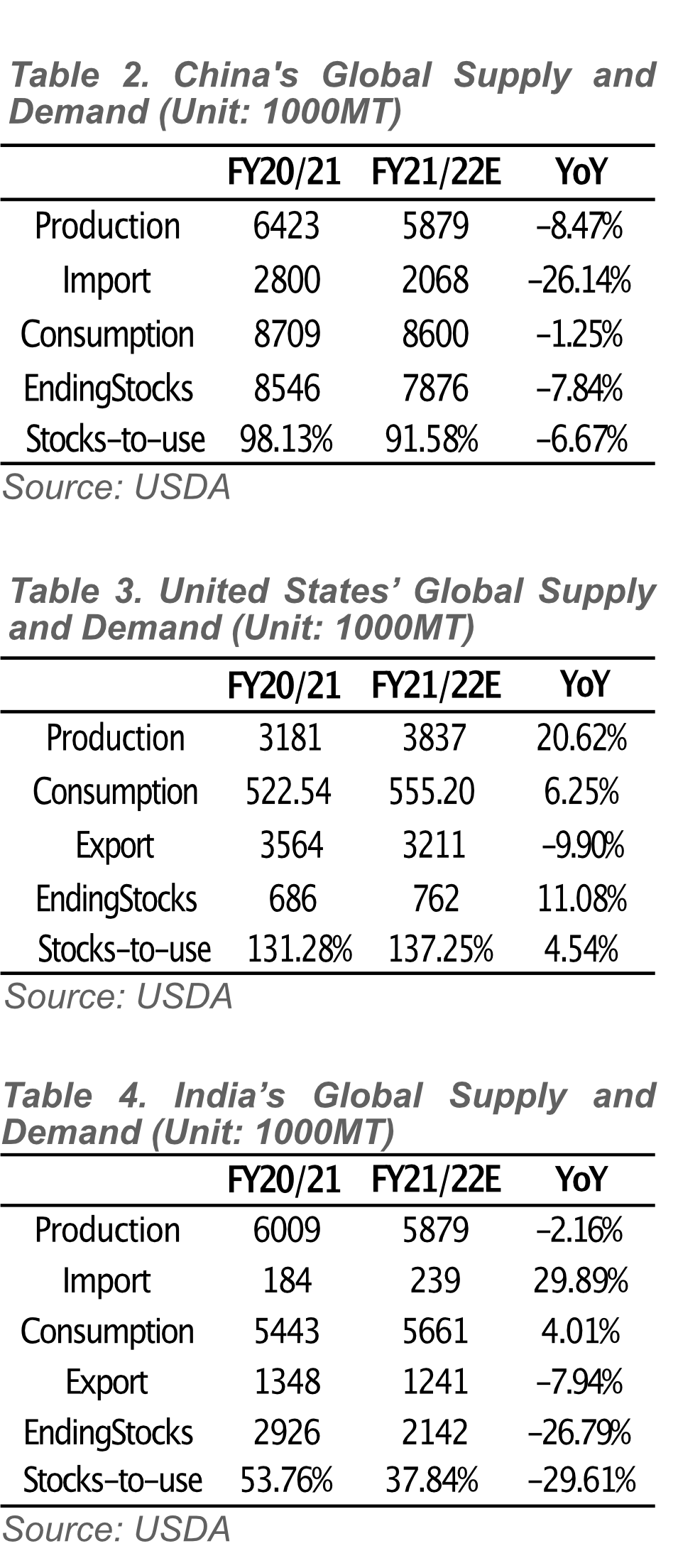

According to table 1, global cotton production in 2021/22 is expected to increase significantly compared with the previous year (2020/2021), consumption will increase slightly, and import volume will decrease, the export volume has been greatly reduced, and the ending stocks have been reduced.

In the 2021/2022, the total output is expected to increase substantially by 6.96%, which means that this year’s harvest is good and the supply is strong. In terms of global consumption, it is also expected to increase by 2.75%. However, we should notice that the import and export have all dropped sharply. Global imports decreased by 5.79%, while exports decreased by 4.83%. This means they are produced for their own consumption, and no longer import or export.

The main reason is the logistics problem. The whole logistics supply chain is facing enormous challenges. High freight greatly increases the costs, but it is difficult to pass it on to consumers. Manufacturers are worried that high cotton prices will increase clothing prices. Some overseas buyers are looking for new sources of supply. In order to retain orders, companies in the cotton textile industry were forced to bear most of the cost increase. From the downstream side, if the high cotton price continues for a long time, it will increase the production cost of a large number of textile factories. It is expected that small textile factories may reduce production or even stop work in the future.

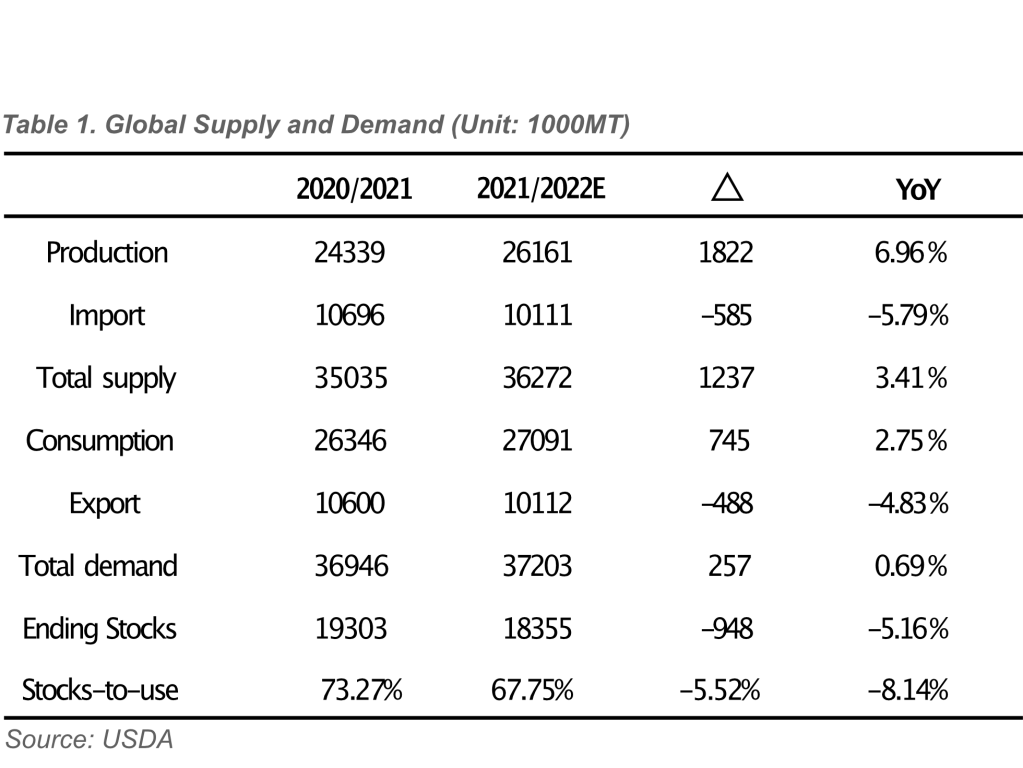

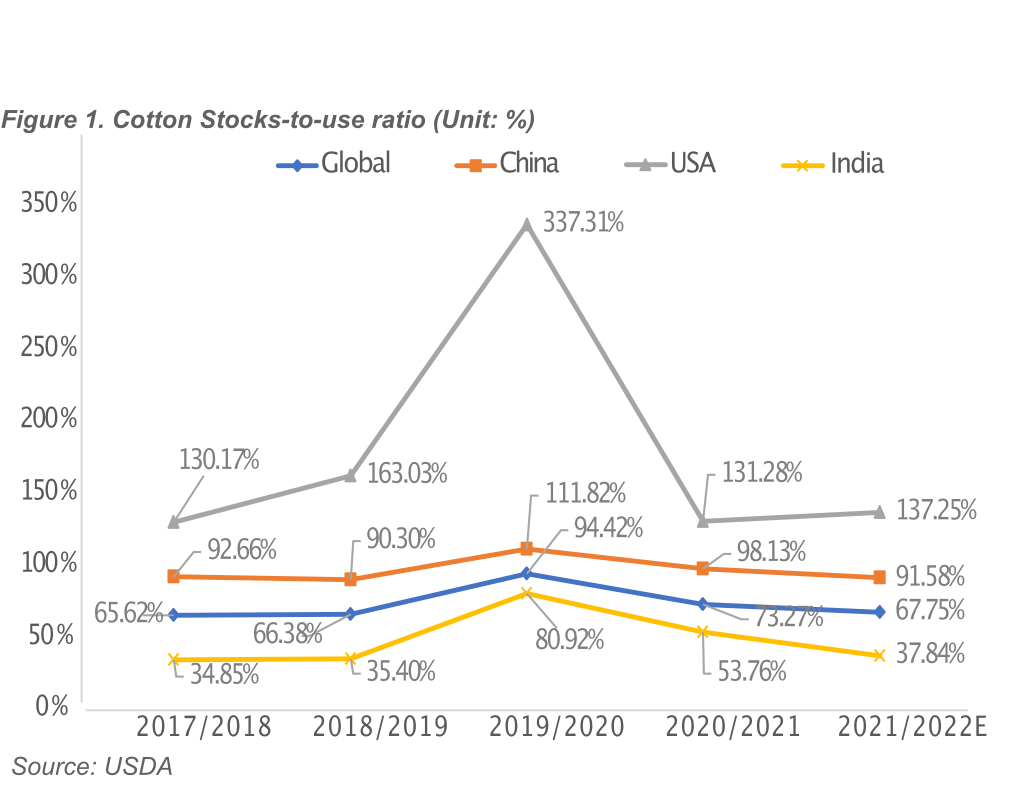

According to figure 1, the statistics shows that the global cotton stocks-to-use ratio is 67.75%. Although it is decreased from last year, it is still at a high level overall. The stocks-to-use ratio in the US is 137.25%, which is still high. China’s stocks-to-use ratio remains above 90%. India’s ending stocks is relatively low, below the global average, but this year’s stocks-to-use ratio has dropped rapidly, from 53.76% to 37.84%.

From a trend point of view, cotton has been in a destocking trend in recent years. From a macroeconomic side, the global economy is already in a period of high inflation and may enter a period of stagflation. Due to the economic weakness in the later period, the cost of newly harvested cotton is higher. Downstream consumption will decline, which will increase the future Stocks-to-use ratio and lead to a decline in cotton prices in the future.