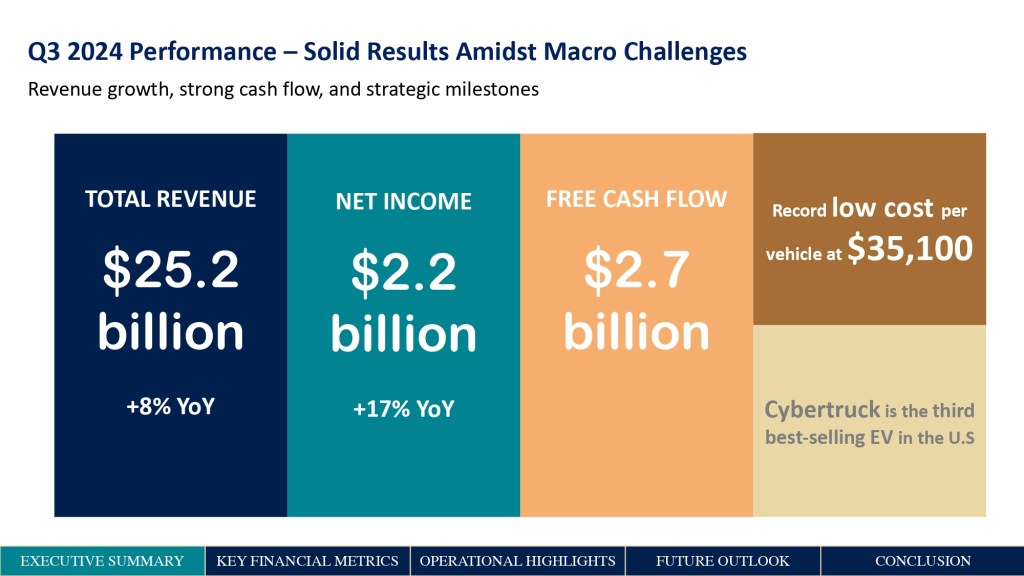

Resilient Financial Performance:

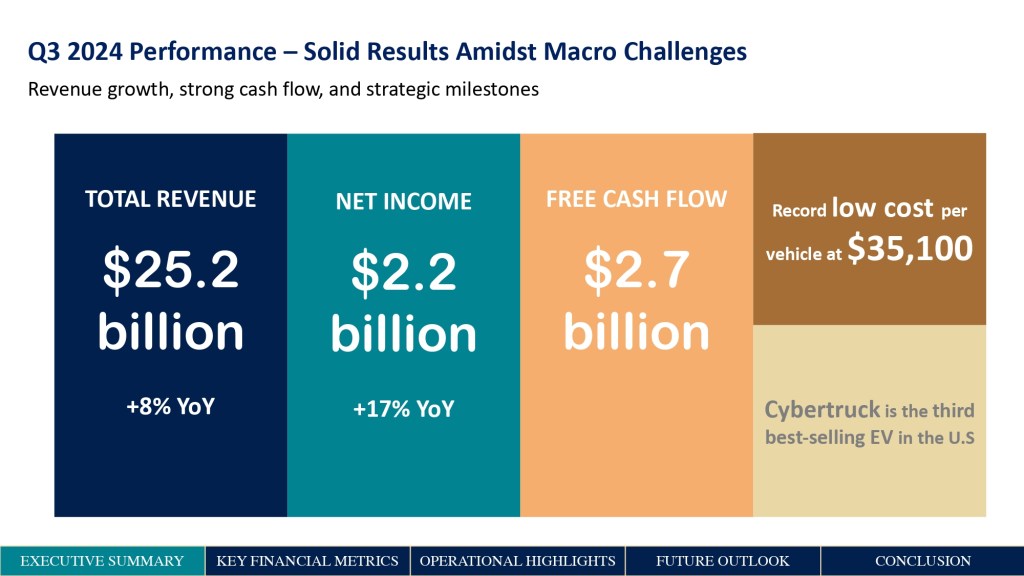

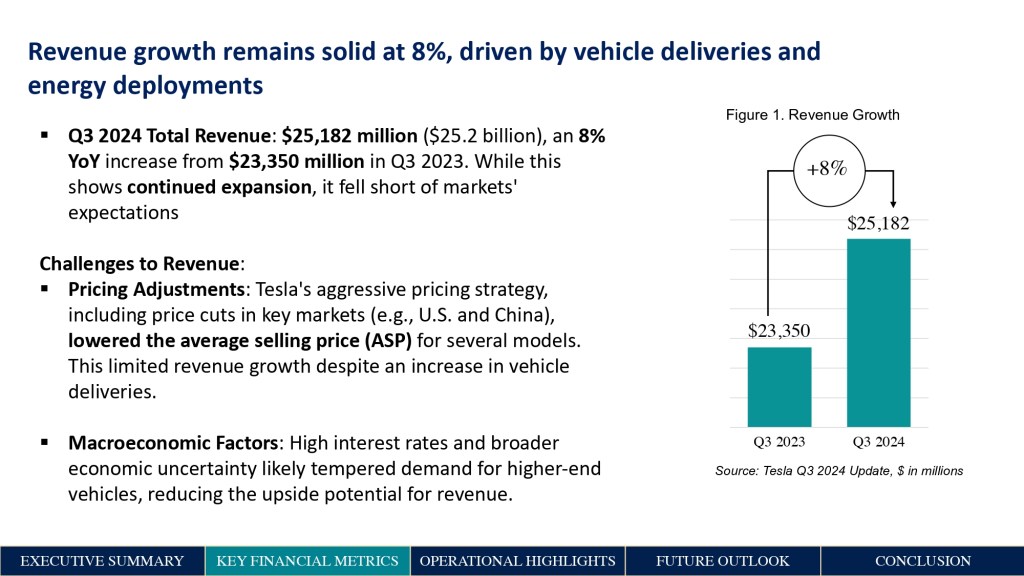

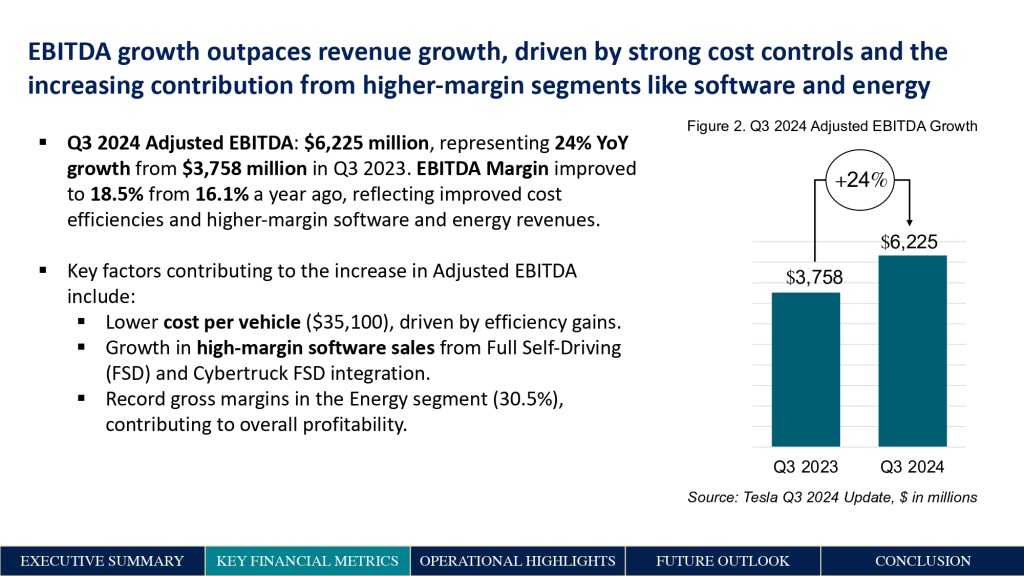

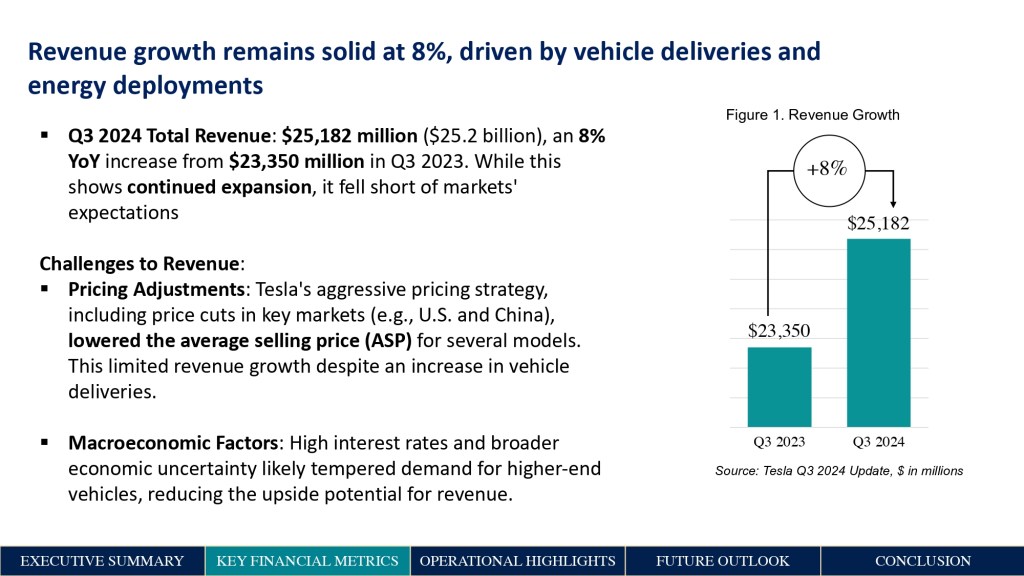

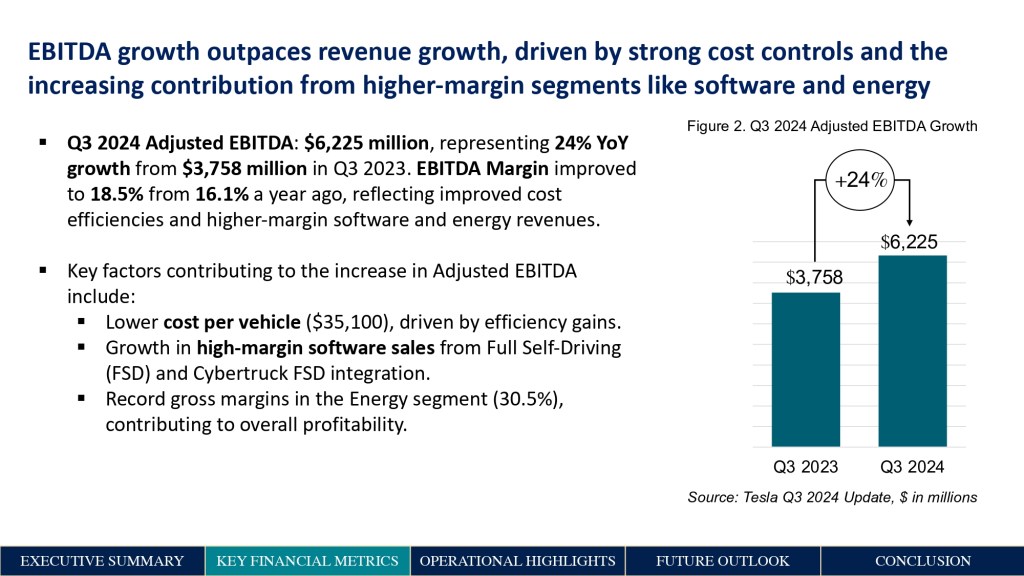

Tesla demonstrated a solid financial performance in Q3 2024 with $25.2 billion in revenue and a 24% YoY growth in Adjusted EBITDA.

While revenue growth remains positive at 8%, the impact of pricing adjustments and macroeconomic factors means Tesla’s top-line performance did not fully meet expectations. Continued focus on scaling the energy business and increasing high-margin software sales will be critical to future revenue growth.

Operational Excellence:

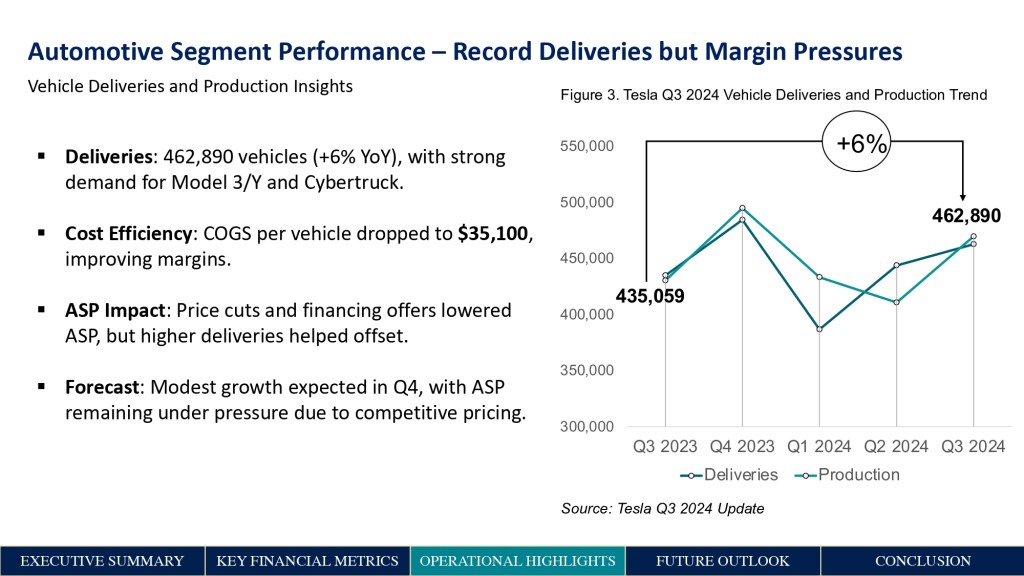

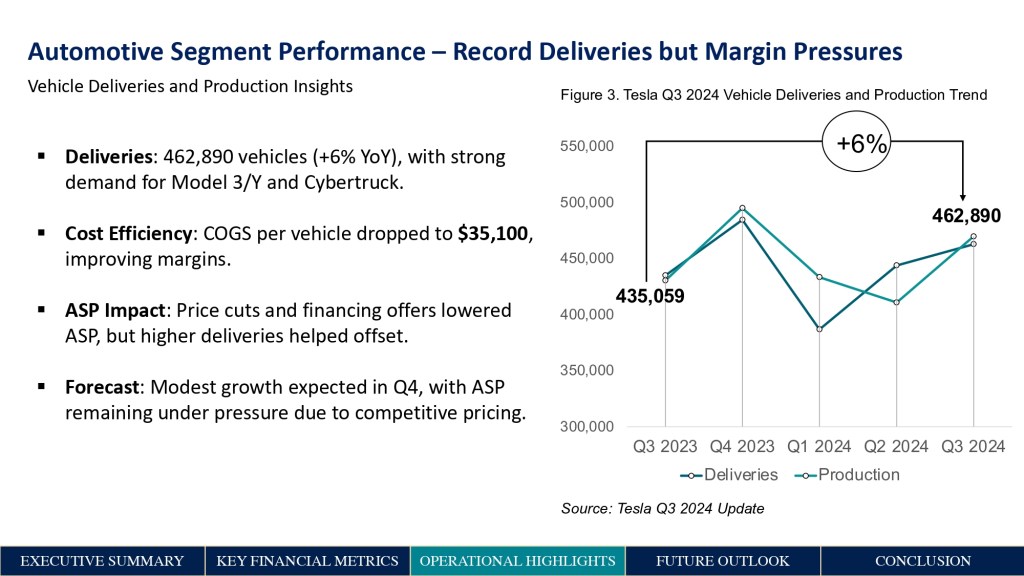

Tesla reached a record-low cost per vehicle of $35,100, reflecting the company’s focus on operational efficiency and supply chain optimization.

Vehicle deliveries increased 6% YoY to 462,890 units, driven by strong demand for the Model 3/Y and the ramp-up of the Cybertruck.

Diversified Growth Engines:

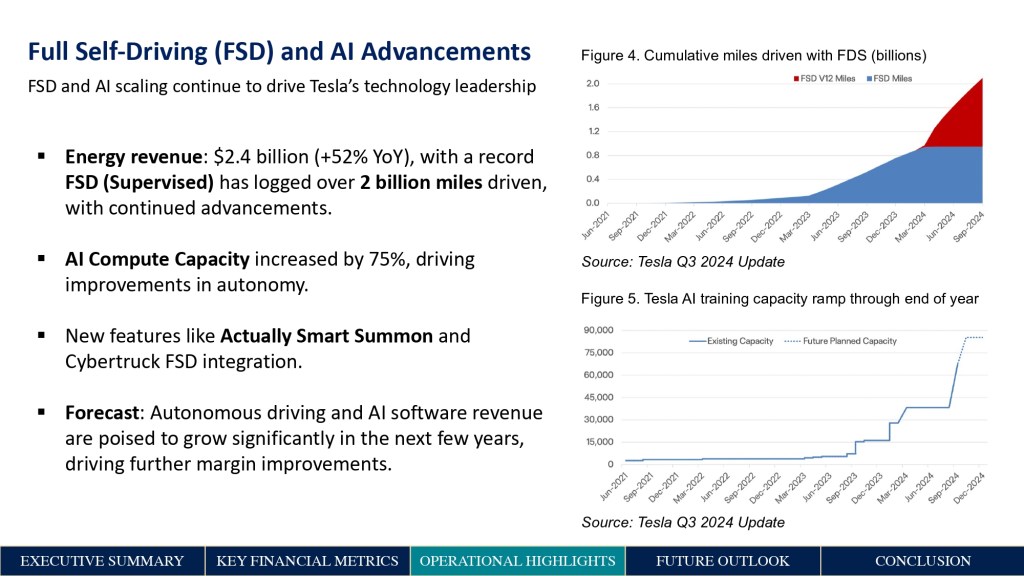

The Energy Generation and Storage segment achieved record revenue of $2.4 billion (+52% YoY) and a 30.5% gross margin, solidifying its role as a key profit driver alongside the automotive business.

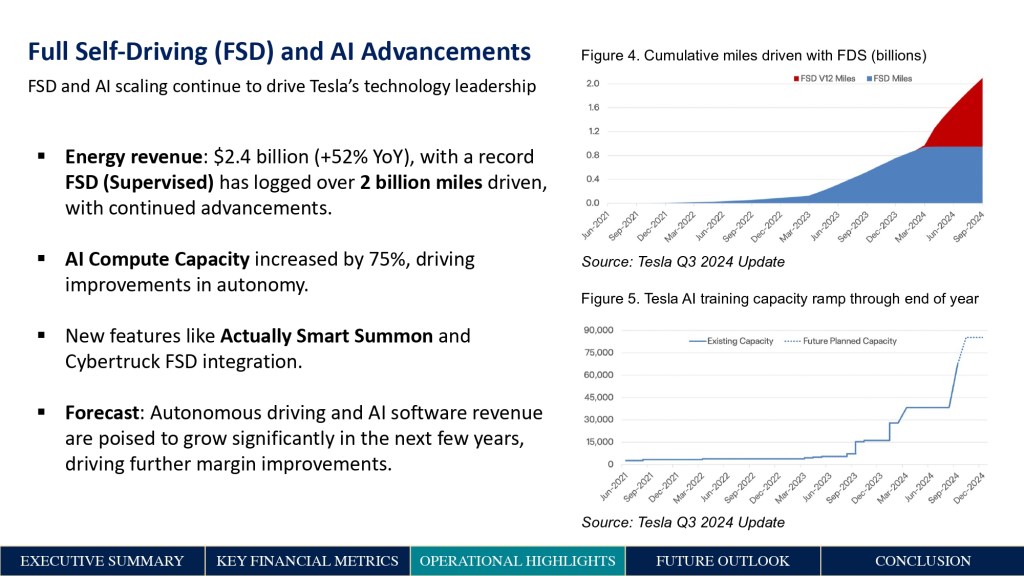

Tesla’s ongoing advancements in AI and Full Self-Driving (FSD), with over 2 billion miles driven and a 75% increase in AI compute capacity, position the company to further monetize its autonomous driving technology.

Strong Cash Position:

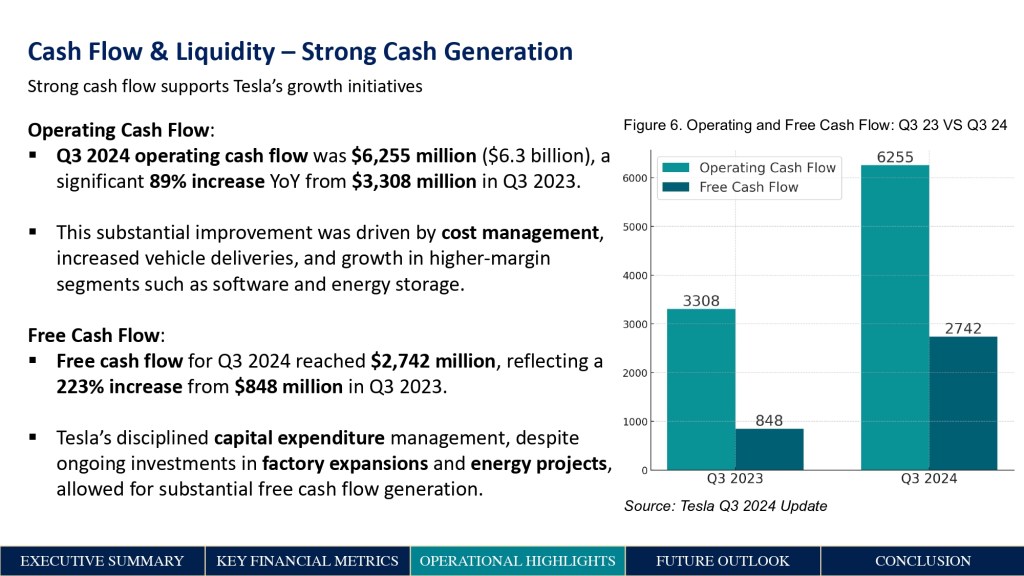

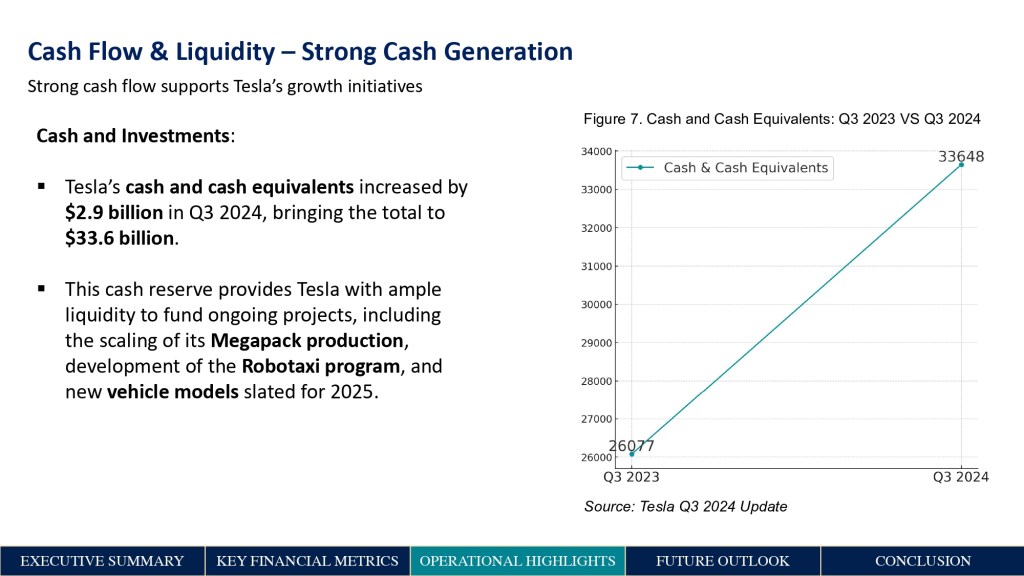

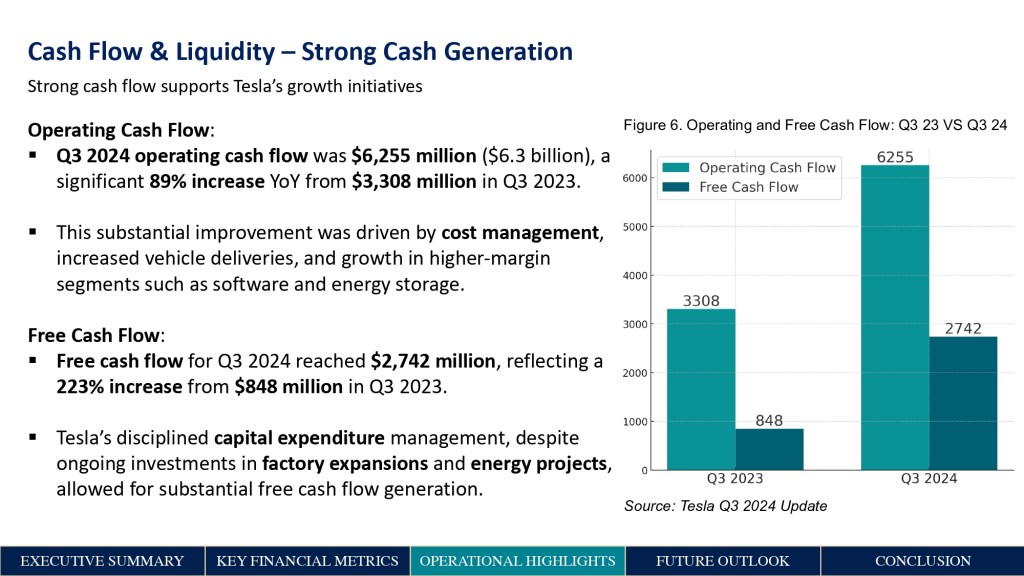

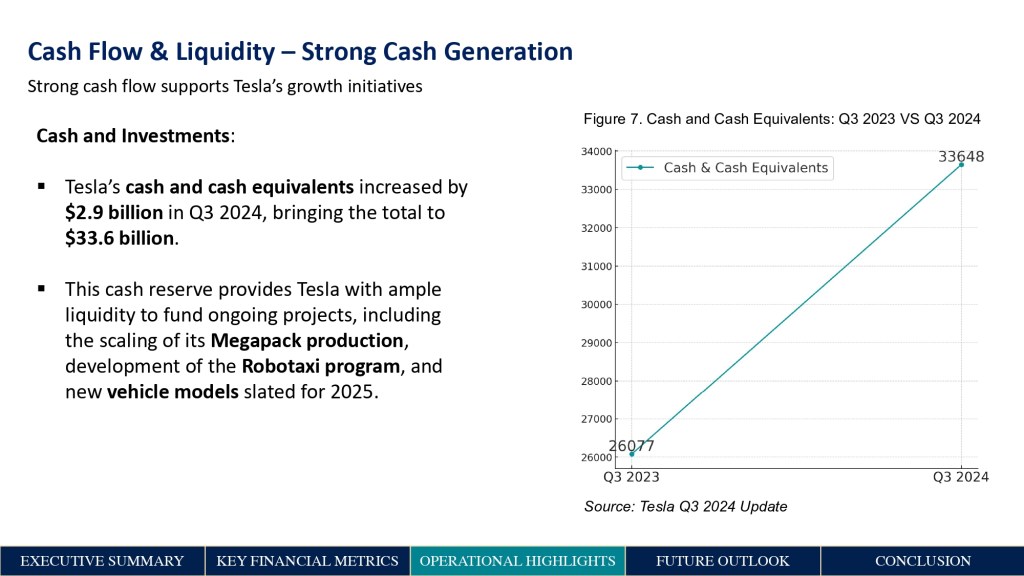

Tesla’s $33.6 billion in cash and investments, supported by an operating cash flow of $6.2 billion and free cash flow of $2.7 billion, provides ample liquidity to invest in long-term growth initiatives such as the expansion of energy storage capacity, AI development, and new vehicle models.